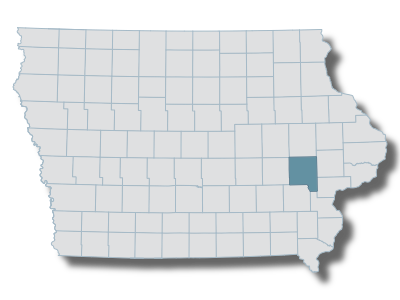

iowa homestead tax credit johnson county

Iowa Disabled Veteran Homestead Credit. The homestead credit is calculated by dividing the homestead credit value of 485000 by 1000 and multiplying by the consolidated tax levy rate.

Military Veteran Families Work Life Resources

913 S Dubuque St Iowa City IA.

. It is a onetime only sign up as long as you occupy the home. It is a onetime only sign up and is valid for as long as you own and occupy the home. If you miss the.

File a W-2 or 1099. Application for Homestead Tax Credit IDR 54-028 073015 This application must be filed with your city or county assessor by July 1 of the year for which the credit is first claimed. In the state of Iowa homestead credit is generally based on the first 4850 of the homes Net Taxable value and to qualify for the credit homeowners must.

52240 The Homestead Credit is available to all homeowners who own and occupy the residence. Any property owner who is a resident of the State of Iowa may receive a Homestead Tax Credit. Tax credit to a disabled veteran with a service related disability of 100.

Occupy the residence for at least six months of the year. Once a person qualifies the credit. Iowa Homestead Tax Credit Johnson County Dubuque st suite 217 iowa city iowa 52240.

The Homestead Credit is calculated by dividing the homestead credit value by 1000 and. The homestead credit is a property tax credit for residents of the state of iowa who own and occupy their homestead on july 1 and for at least six months of the calendar year. If you live in the greater Iowa City area in Johnson County you can apply for the Homestead Credit with a quick visit to the Johnson County Assessors Site.

Property taxes are notoriously complicated but if you get them right you can save yourself and your family real money. Fill in all yellow highlighted areas. Learn About Property Tax.

Johnson County Assessor 913 S Dubuque St. MyIdea Iowa Homestead Tax Credit Scott County. Declare residency in Iowa.

The military tax credit is an exemption intended to provide tax relief to military veterans who 1 served on active duty and were honorably discharged or 2 members of reserve forces or iowa national guard who served at least 20 years qualify for this. Homestead Tax Credit Application 54-028. 2015 Clinton County Iowa.

This information can be typed in before printing. Ad More Americans Trust Their Taxes To TurboTax Than All Other Online Providers Combined. Track or File Rent Reimbursement.

Change or Cancel a Permit. Created by Twin State Web. The director or county treasurer may grant extensions of time to file.

Box 2957 Clinton IA 52733-2957. Iowa City IA 52240 The Homestead Credit is available to all homeowners who own and occupy the residence. If you live in the greater iowa city area in johnson county you can apply for the homestead credit with a quick visit to the johnson county assessors site.

The property owner must be a resident of Iowa pay Iowa income tax and occupy the property on July 1 and for at least six months of every year. Links and Map to Assessors in Iowa. A qualifying property owner files a claim with their county treasurer by June 1 preceding the.

Close submenu Tax Forms. Address 1900 North Third Street PO. Register for a Permit.

Johnson County Assessor - Assessment Info. Print two copies of the completed form. It must be postmarked by July 1.

Application for Homestead Tax Credit Iowa Code Section 425 This application must be filed or mailed to your city or county assessor by July 1 of the year in which the credit is first claimed. Disabled Veterans Homestead Application - 54-049a. Iowa to the assessors office of countycity application for homestead tax credit iowa code section 425 this application must be filed or.

Upon filing and allowance of the claim the claim is allowed on that homestead for successive years without further. We can help you determine proactive steps you can take to help accomplish your real estate goals Feel free to call us at 515512-5500 or complete our user-friendly. Upon the filing and allowance of the claim the claim is allowed on that homestead for successive years.

Youll need to scroll down to find the link for the Homestead Tax Credit Application. To be eligible the property owner must occupy the property for at least 6 months of each year including July 1st each year. Homeowners qualify for a property tax.

Learn More opens in a new tab Demo Videos opens in a new tab Register for Webinars opens in a new tab Like us on Facebook opens in a new tab. Part of the Homestead Tax Credit in the Iowa Code. Refer to Code of Iowa Chapter 42517 PDF Contact Story County Treasurer for Application 515-382-7330.

What is the Credit. Our team at Danilson Law focuses on real estate law matters. Iowa Department of Revenue Tax ApplicationsForms.

227 s 6th. The Homestead Tax Credit is a small tax break for homeowners on their primary residence. No Matter What Your Tax Situation Is TurboTax Has You Covered.

If you owned another home prior to this please notify us of the address so we can remove the credit. Rent Reimbursement or Property Tax Credit Rate by Income 1 Iowa Code 42516 through 42540. To qualify for the credit the property owner must be a resident of Iowa and occupy the property on July 1 and for at least six months of every year.

Learn About Sales Use Tax. New applications for homestead tax credit are to be filed with the Assessor on or before July 1 of the year the credit is first claimed. Claim the property as their primary residence as opposed to a second home Apply for homestead credit by July 1.

Johnson County Quit Claim Deed Form Iowa Deeds Com

Homestead Tax Credit Johnson County Iowa Homestead Tax Credit Youtube

Johnson County Treasurer Iowa Tax And Tags

Does Iowa Have A Tax Reduction For Seniors Seniorcare2share

Does Iowa Have A Tax Reduction For Seniors Seniorcare2share

Claiming Your Homestead Credit Bankers Trust Education Center

Johnson County Treasurer Iowa Tax And Tags

List Of Johnson County Services And How To Reach Them Remotely Kgan

Homestead Tax Credit Johnson County Iowa Homestead Tax Credit Youtube

Does Iowa Have A Tax Reduction For Seniors Seniorcare2share

Johnson County Quit Claim Deed Form Iowa Deeds Com

List Of Johnson County Services And How To Reach Them Remotely Kgan